The Changing Compensation Environment

As the former CEO of a credit union, it’s crucial for me to understand the landscape of Supplemental Executive Retirement Plans (SERPs). Cardwell Consulting has been conducting research for 22 years as detailed in the 2023 Pearl Meyer CEO and Senior Executive Total Compensation Survey. While this survey focuses on CUs with assets over $1 billion and SERP prevalence is generally lower in smaller institutions, there are insights applicable across all CU asset sizes.

Key Findings on SERP and Compensation Practices for CEOs:

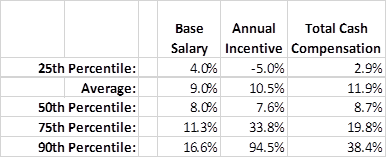

- Compensation Trends for CEOs who had the same role last year:

- Non-Qualified Benefit Plans: Over 90% of CU CEOs have a Split Dollar (SD) or 457(f) SERP. SD plans have grown substantially over the last decade.

- Target Retirement Income: Our SERPs are typically structured around a total retirement income target, or “replacement ratio,” mostly funded by the employer. Common targets range from 60%-65%, with some going as high as 70%-75%. It’s rare but not unheard of to see targets over 80%. Replacement ratios often reflect the CEO’s tenure and their impact on the organization.

- Factors Affecting SERPs:

- Pay Definition: About 75% of CEO SERPs consider both base salary and annual incentives in calculating the replacement ratio.

- Compensation Averaging: The averaging period for compensation usually spans three to five years. Some use the final year’s pay, especially when the benefit is based solely on base salary.

- Service Period: The competitive benefits are typically associated with 15 years of service, not all necessarily as CEO. For newly recruited executives this period might be shorter.

- Tax Adjustments: Less than 20% of CUs make explicit adjustments for the tax implications of SERP benefits paid through 457(f) plans. However, insurance-funded plans are effectively tax-adjusted due to the inherent tax advantages of life insurance.

SERP Practices for Non-CEO Executives:

- Prevalence and Inclusion: While over 90% of CEOs in larger CUs have SERPs, the figure for other senior executives is above 70%. Commonly included positions are COOs, CFOs, and increasingly the entire C-suite.

- Benefit Structure: Non-CEO executives generally have a 5-10% lower replacement ratio compared to CEOs. There’s a growing trend towards retention-focused plans for younger executives, transitioning to retirement-focused structures as they approach retirement age.

In summary, these SERP practices reflect our commitment to competitively compensating our leadership, ensuring the long-term success and sustainability of our credit union. This comprehensive understanding helps us in strategically planning executive compensation and benefits.

Myself and PARC Street Partners are happy to assist in developing unique SERP options for your executive team. You can reach me here.